Advertising disclosure

Hosting Canada is community-supported. We may earn a commission when you make a purchase through one of our links. Read Disclosure.

A Beginner’s Guide to Online Trading

Hi, my name is Gary and I’m the owner/writer at Hosting Canada.

Hi, my name is Gary and I’m the owner/writer at Hosting Canada.

While the majority of my work is centered on web hosting technology, I’ve been researching online brokerages for more than 15 years and writing about them for at least five.

Back when I started online trading, I remember paying $8.99 per trade at TD.

Since that time, a lot of really cool online brokers have popped up, some of them even offering one-cent trades.

Now, the industry has come a long way and there are almost too many great tools at this point to keep track of.

In this guide, I’m going to try to help you through some of the tools, strategies, terminology, and beginner resources to start trading online.

This is an ongoing project which I’ll keep updating. If you guys have any questions, don’t hesitate to contact me.

What is Trading? 🛍️

“Trading” online in any form involves buying or selling certain assets or asset trading agreements using the stock market as a medium. In simpler terms, trading means buying or selling things on the stock market!

However, although the stock market implies that only stocks are sold and bought there, other types of currencies can also be traded depending on your needs and financial goals.

Although trading on the stock market requires a level of financial sophistication, there are many people who believe that they can’t trade since they don’t have a degree in economics.

Nothing could be further from the truth. In reality, anyone can trade online, especially since they are user-friendly apps and platforms that make trading easy and include educational materials.

How Can You Trade Online? 📈

In prior decades, people had to be physically present at the stock market in order to trade, or they had to make phone calls to brokers who would put trades through for them.

In prior decades, people had to be physically present at the stock market in order to trade, or they had to make phone calls to brokers who would put trades through for them.

A stockbroker (or any kind of trading broker) is an intermediary that makes a purchase or sale for their client.

Some brokers are more experienced than others and serve a dual purpose as quasi-financial advisors, helping their clients make smart trading decisions.

In exchange, they take a small cut of any profits from the trades: this is called their commission.

On the other hand, some stockbrokers are little more than intermediaries that put your trades through and don’t discuss your overall strategy.

The latter type of broker is more useful for those who already have plenty of experience trading online.

To trade online, you’ll either utilize a broker or trading app like Questrade, eToro or Robinhood or visit a desktop website that allows you to trade on the stock market. Either way, both types of platforms will require you to make an account and fund that account so you can start buying shares or other stock market assets.

In today’s modern world, trading online happens instantaneously, and that opens up multiple opportunities to play the stock market depending on your interest, financial goals, and personal experience.

Trading Apps and Platforms

Trading apps and platforms are best thought of as the windows through which you access the stock market and make your trades.

Trading apps and platforms are best thought of as the windows through which you access the stock market and make your trades.

Most trading apps these days can be run on desktop computers and modern mobile devices, such as smartphones and tablets.

Trading apps will contain dashboards that allow you to choose which assets to buy or sell, overview your portfolio (a collection of all your positions – assets you currently hold), and set “stop-loss” and other automated functions.

Trading platforms are tools that trading apps utilize to allow you to buy or sell. Of them all, two stand out as the most popular and widely-used: MetaTrader 4 and 5. These trading platforms contain a plethora of tools to let you customize your buying and selling experience, including some of the automated tools mentioned above.

Trading Assets

In order to understand exactly what you’re trading on the stock market, it helps to understand what each asset represents. Trading on the stock market isn’t (always) just about moving meaningless numbers around!

Stocks 🗠

Stocks are the basic market asset to trade, and they’re also the easiest to understand. In a nutshell, a stock is a physical share in a company.

Think of it as a piece of ownership. As the market value for a company goes up, the price for its various stocks also rises, meaning that owners can then sell those stocks later for a profit.

For example, if a company has an overall net worth of $2 million and 100 shares, then each share of stock is worth $20,000. However, most companies have many more shares than this. Share prices, especially for particularly successful companies, usually range between $50 and $100 a share.

Stocks are a great place to start if you’re a beginner to online trading since they’re relatively easy to grasp. The more stocks you own, the more you own a particular company. If you own a majority of the shares in a company, you are the majority shareholder.

Options 🗂️

Options are a little more complex, especially since they don’t represent the ownership of a particular stock or asset. Basically, options are contractual agreements that give a buyer or seller the right to buy or sell an asset at a later date at an agreed-upon price.

For example, you might see an Apple share for $50. An “option” would then allow you to buy that share of Apple stock at $50 by a certain date and time, regardless of how the market fluctuates in the meantime.

So, in this example, if Apple’s stock price rose to $70 a share, but you had an option to buy the share for $50, you could still buy the share at a discount even if everyone else had to buy shares at $70.

This way options become assets that experienced traders are able to use to play the stock market and make a profit based on predicting certain trends. This is done by analyzing which companies are most likely to gain or lose value over the short and long-term.

Options are classified as either “calls” or “puts”. A call option reserves the right to buy a share at a given price before a particular date, while a put option reserves the right to sell a share at a particular price before a certain date.

It is not impossible for beginners by any stretch of the imagination to learn Option trading. But it is a little more complex and it requires some knowledge of stock market trends in order to perform effectively.

Forex and Currencies 💱

Forex stands for “foreign-exchange”, although it’s also known as currency or FX trading.

Forex stands for “foreign-exchange”, although it’s also known as currency or FX trading.

In a nutshell, trading forex means that you are trading different foreign-exchange currencies for more foreign-exchange currencies, theoretically making a profit based on the moment to moment price differences that can fluctuate every day and throughout the year as global events unfold.

Say that the US dollar loses a little bit of value. You could then buy forex securities for US dollars and stockpile them until the US dollar gains value over the next fiscal quarter. When the US dollar is at its peak value, you could then sell those forex securities for a huge profit for other types of currencies.

As you can see, forex trading is a little more complex than either of the other two options discussed so far. For this reason, forex trading isn’t recommended for beginners until you get some experience in seeing how the market evolves and changes over the course of a fiscal year.

Futures and Commodities 📄

Futures are types of contracts that agree to an organized exchange to buy or sell assets at a certain price, even though they will be paid for and delivered later. Futures contracts are primarily used by big buyers and sellers or companies (or their representatives).

The typical example is a farmer. He might want to sell all of his crop of corn at a particular price when the harvest comes in, regardless of the actual value of corn when the growing season is over.

A buyer might take them up on that offer since it guarantees that the buyer will receive that crop of corn no matter what, even if both parties potentially miss out on a little extra profit.

Futures are secure trades meant to establish market stability rather than to make big profits. But experienced traders can trade futures for high profits if they know how to predict market trends and analyze human behavior.

Commodities and futures are often discussed in the same breath since most futures contracts deal with, well, commodities like foodstuffs, oil, and other bulk resources.

But you can buy and sell commodities contracts for alternative purposes.

Cryptocurrencies ₿

Lastly, cryptocurrency trading is the newest of all types and involves speculative trading over the values of different cryptocurrencies like bitcoin and similar assets.

Keep in mind that while people are technically allowed to use cryptocurrencies in Canada, the federal government doesn’t recognize these currencies as a form of legal tender.

So while you might technically make it big with cryptocurrencies if you trade with them, you won’t be able to spend the money in Canada unless you exchange it for another type of currency.

Ultimately, the different assets involved in online trading will determine your profits and the kind of trading activity you undertake. As mentioned, we’d recommend focusing on stock trading to start out, with maybe a little dipping into options as you gain experience and delve through the educational materials on this site and your trading platform or app.

Types of Trading

You should also learn about different trading strategies before you start making moves on the stock market.

Day Trading 📆

Day trading is both very common and one of the first types of trading undertaken by beginning online traders. That’s because it relies on short-term strategies and can result in tangible profits or losses over the course of a single day.

Day trading is both very common and one of the first types of trading undertaken by beginning online traders. That’s because it relies on short-term strategies and can result in tangible profits or losses over the course of a single day.

This type of trading used only be undertaken by professional traders, but the plethora of fantastic online trading apps and platforms have opened up opportunities for regular people to reap similar rewards.

As the name suggests, day trading involves buying or selling one or more securities or financial instruments over the course of one trading day.

That means you need to buy and/or sell their positions before the final bell and the market closes. This carries a certain amount of risk, as even the best predictive algorithms and trading experts cannot predict perfectly how the market will react to daily fluctuations and decisions.

However, day trading allows you to make small but important profits as you purchase and sell stocks and currencies with high liquidity. But being a day trader means spending most of your time and energy researching appropriate strategies and staring at charts.

It’s not a side gig by any means, and successful day traders have to train themselves to be unemotional about their work so they don’t make any last-second gut decisions and ruin the day’s earnings.

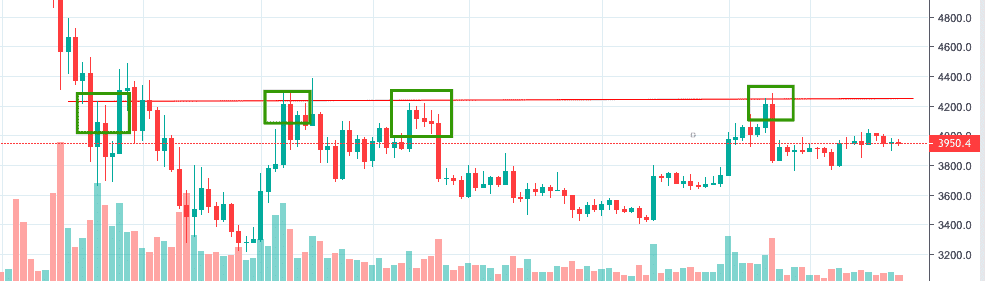

Swing Trading 🏌️

Swing trading is a more maneuverable type of trading that has you adjust your positions over the course of days or weeks, instead of doing so over a single day. It’s a little less time-intensive, and thus it’s appropriate for traders that need to hold down a day job or juggle other responsibilities at the same time as they grow their portfolio.

Swing trading literally refers to following the swing of the market. You try to predict what stocks will rise in value, buy those before they uptick, then sell those stocks when they start to swing down. It’s relatively simple to grasp, but there’s a high-profit ceiling where you can make big money if you master the fundamentals required to swing trade successfully.

Furthermore, swing trading is an excellent way to diversify your portfolio. It’s a little less risky, too, since a single bad day is less likely to completely empty your account or ruin your portfolio compared to day trading.

Position Trading ⌚

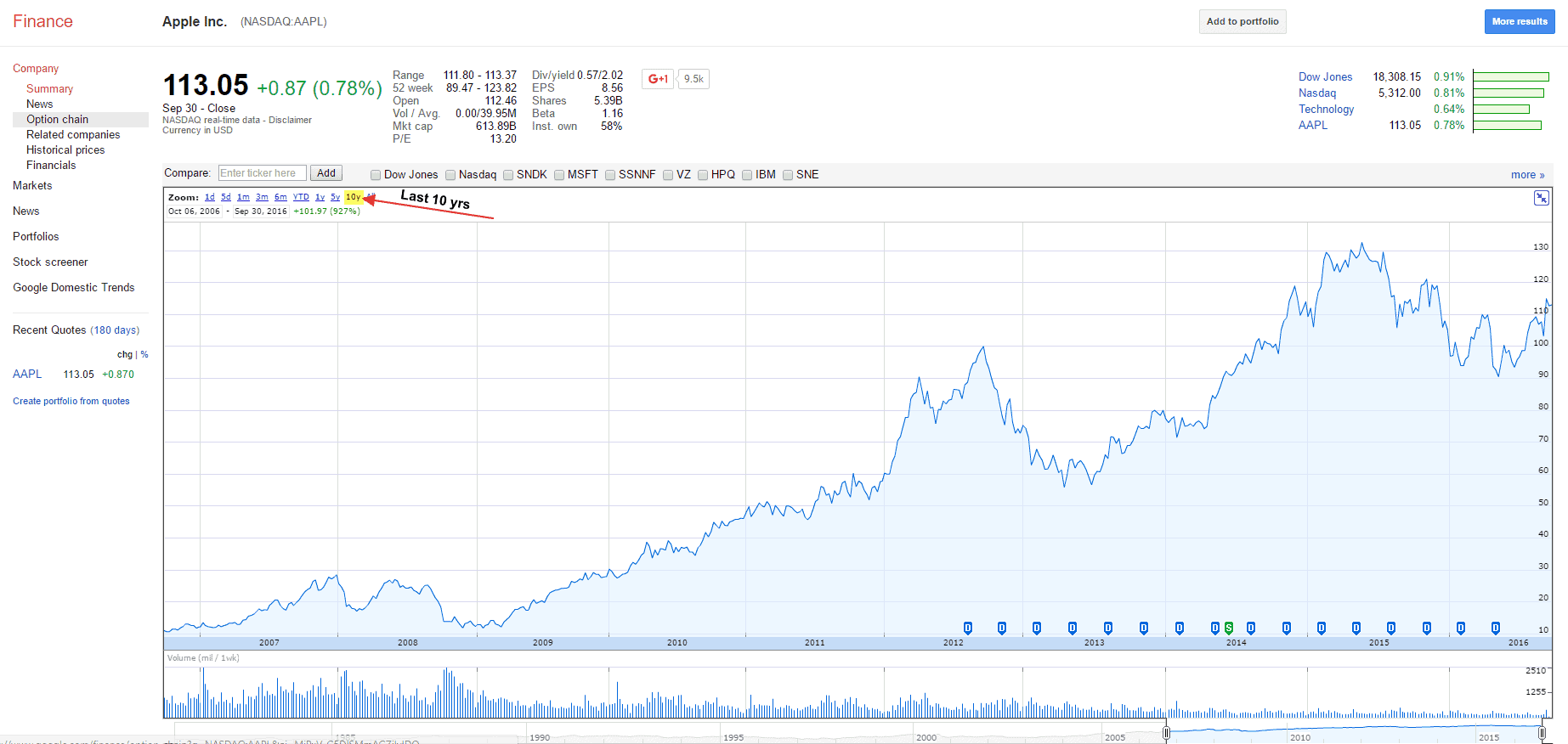

![]() Position trading is a kind of long-term trading strategy. With this strategy, a trader will buy and hold securities for relatively long periods of time.

Position trading is a kind of long-term trading strategy. With this strategy, a trader will buy and hold securities for relatively long periods of time.

Indeed, the trader in this example would theoretically keep those stocks were securities for up to months or even up to a year (or longer in certain cases).

As you might expect, buying and selling decisions are influenced primarily by heavy research and in-depth understanding of market trends. It’s not a great strategy for beginners, who more often than not lack the understanding required to make profitable, long-term position trades.

A position trader would theoretically buy a stock or security at the beginning of a trend and sell when they projected the trend to reach its maximum height or profitability. This type of trading can result in fantastic long-term profits, but the fruits of this labor are often a long ways off.

Thus, it’s only a good choice for patient online traders or those who don’t mind letting their efforts simmer for a while before they reap the rewards.

One more thing: successful position trading requires that you have an app or platform to provide you with accurate trading information. Without good information, you won’t be able to make successful position trading predictions.

CFD Trading 🧮

CFD or contract for difference trading occurs when traders speculate on price movements for particular stocks. A CFD contract doesn’t give ownership of the applicable stock. Instead, it’s literally a contract guaranteeing the right to speculate on market price change in the future. In this way, it’s a kind of options trading more than anything else.

This being said, CFD trading does include a high level of risk relative to other types available. That’s because you have to accurately predict price changes for certain stocks or assets over significant time frames. This does mean you can potentially gain fantastic profits if you’re skilled or successful, however.

Scalping 💨

Scalping is often utilized in conjunction with day trading, as it’s extremely fast. In short, scalping will have the trader in question take advantage of certain gaps created by bidding and the spread and order flows created by other traders on the market.

Basically, profits are made by selling a stock or contract at an asking price that’s higher than the overall buying price or spread of a given security. This reduces the risk of day trading somewhat if you can get the hang of it, but it also involves making very small profits at a time.

Thus, it’s really only suitable for making long-term profits if you scalp frequently and skillfully. This does mean that it can be a good way to learn the ropes of online trading since you never risk more than a few tens of dollars at a time.

Additionally, while the profit margins for every individual trade is fairly low, the profits can quickly add up if you are successful overall.

What About Traditional Investment Accounts? 🎩

Of course, don’t forget about traditional investment accounts! Most Canadians (and indeed, most people in the Western world) already invest “traditionally” in the form of their IRAs or 401(k)s.

These investment accounts are usually handled by an employer or a trading brokerage that makes relatively safe but reasonably aggressive buying decisions in order for clients to benefit from the general upward trend of the stock market.

A traditional investment account should slowly grow over time, and clients can invest more of their money as they become wealthier so they can grow their retirement nest eggs. These types of accounts for traditional investments can be accessed through online portals and apps just like the kinds of tools discussed above.

If you already have a traditional investment account, good for you! If you don’t, consider opening one (like an IRA if you are self-employed or don’t have a traditional employer). This is a great way to diversify your portfolio and guarantee some manageable savings while you act a little riskier with your day trading account, for example.

How to Start Trading

Alright! That was a lot of information, but hopefully you now have a foundation from which you can start looking into trading options and strategies. If you want to start online trading today, here’s what you need to figure out first.

Choose a Broker/App 👨💼

![]() Before doing anything else, you need to look at the different online brokers and trading apps available to you.

Before doing anything else, you need to look at the different online brokers and trading apps available to you.

The great news is that online trading apps and online brokerages are plentiful, and Canadians can benefit from some of the top trading apps in the industry.

However, different brokers or mobile apps have different advantages and benefits. For instance, some online trading apps don’t carry any commission fees or minimum investment amounts.

A minimum investment amount is a minimum amount of cash you need to fund your account with before you can start trading through that broker or app.

Naturally, apps with minimum amounts are more suitable for those with more cash in reserve. Apps without a minimum amount are more suitable for beginners that don’t have a lot of extra cash to begin with.

How to Choose a Broker/App? 👔

Next, consider the educational tools and customer support that a given brokerage app or online trading platform provides. Educational tools are particularly helpful for beginners to online trading, as they may contain even more in-depth guide than this one or provide you with some pointers as to what stocks or securities you should buy as you start out.

But when you’re researching online brokers to choose, also consider different automated tools or functions that an app might come with.

One of the big things to look for is a “stop-loss” tool. In a nutshell, this kind of tool will allow you to set an automated alert that sells your security when it drops to a specific price or value.

This results in a loss, but it prevents you from losing your entire account balance from a single bad trade. It’s an invaluable tool for beginners that will more than likely have to take some losses in stride before they learn the ropes.

Other online brokers and trading apps might include “match trading” functions that allow you to pick an experienced trader and match their purchases or sales one-to-one.

Naturally, this only really works if you find a trader that knows what they’re doing. But it can be invaluable if you have a friend who already trades online frequently and is willing to let you tag along for a while.

Consider Your Finances and Goals 🏦

While picking your online trading app or broker, you should also consider your overall financial goals and your initial investment amount. Do you have $100 to spend on trading, or 1000? $10,000? It all affects the kind of online trading app you should choose and what your goals ought to be.

If you want to be a day trader, for instance, it’s more than likely that your goal is to make trading your primary occupation. So you don’t need to worry about steady slow growth, over decades of time. Instead, you need to focus on funneling as much cash into your account as possible so you can make more profits.

On the flip side, traditional investment accounts are all about steady and sustainable growth with a minimum of risk.

How Much Time Do You Have? ⏱️

![]() As mentioned, trading strategies like day trading require you to spend all day hunched over a computer and working with the stock market.

As mentioned, trading strategies like day trading require you to spend all day hunched over a computer and working with the stock market.

This is appealing to some, but not to others. Consider the total time you have to invest with your, well, investments and that will give you some insight into what apps are best suited for your goals.

Some apps and brokers are perfect for day trading, while others are better for swing trading or position trading over the long-term.

The latter two types are often better choices for those more interested in a part-time commitment to online trading instead of those looking to make it their first profession.

Opening Fees and Commission Fees 💸

Lastly, be careful about using an online brokerage app or trading platform without looking at their opening costs and commission fees. As mentioned earlier, online brokers will usually charge a commission fee in exchange for their advice and services. This can be anywhere from 1% to 10% or anything in between.

If an app doesn’t charge a commission fee at all, chances are you won’t get a lot of assistance with your trades or much customer support. But that’s a bonus for traders that are confident in their own abilities who want every cent they earn to go back into their own account.

Opening fees are small charges that allow otherwise free apps to stay up and running. Naturally, the cost of these fees can affect what brokerage apps are available to you. If you only have $100 to spend on the market but an opening fee is $1000, that app isn’t a good fit.

Types of Trading Accounts

Broadly speaking, brokerage or trading apps will allow you to make one of three types of accounts.

Cash Accounts 💵

These are also called “without margin” accounts, and they limit you to trading only the money contained in your account.

These are also called “without margin” accounts, and they limit you to trading only the money contained in your account.

This both puts a limit on how much profit you can make, but it also protects you from losing too much.

This is a good choice for beginners or those who have trouble keeping their instinct to buy in check. And a great way to protect yourself while trading.

Margin Accounts ↔️

Next, these accounts will have you borrow money from your broker or brokerage agency. This increases your potential profit ceiling, but it can also lead you into terrible debt if you have a few bad days.

It’s not a great idea for beginners who are more likely to make big mistakes when they are first starting out.

Professional Accounts 🥼

This last account type is best for experienced traders that don’t need a lot of support and who want the most freedom possible when performing their trades. It usually comes with more leverage (borrowable money) for forex and cryptocurrency trades, for instance, with the requisite level of increased risk and potential profits.

Trading Jargon and Terminology to Know

Getting into trading is difficult if you aren’t already familiar with the language. Here are a few major terms you should know before starting your trading journey.

- 🥯 Beta – This is a numerical sign that tells you how much a stock has fluctuated relative to the rest of the market.

- 🐻 Bear – This describes an attitude where a trader expects a stock to decrease in price

- Bear market – Is the attitude where stocks are likely to fall in value

- 🐮 Bull – Describes an attitude where a trader expects a stock to increase in price

- Bull market – Means the market is trending upward

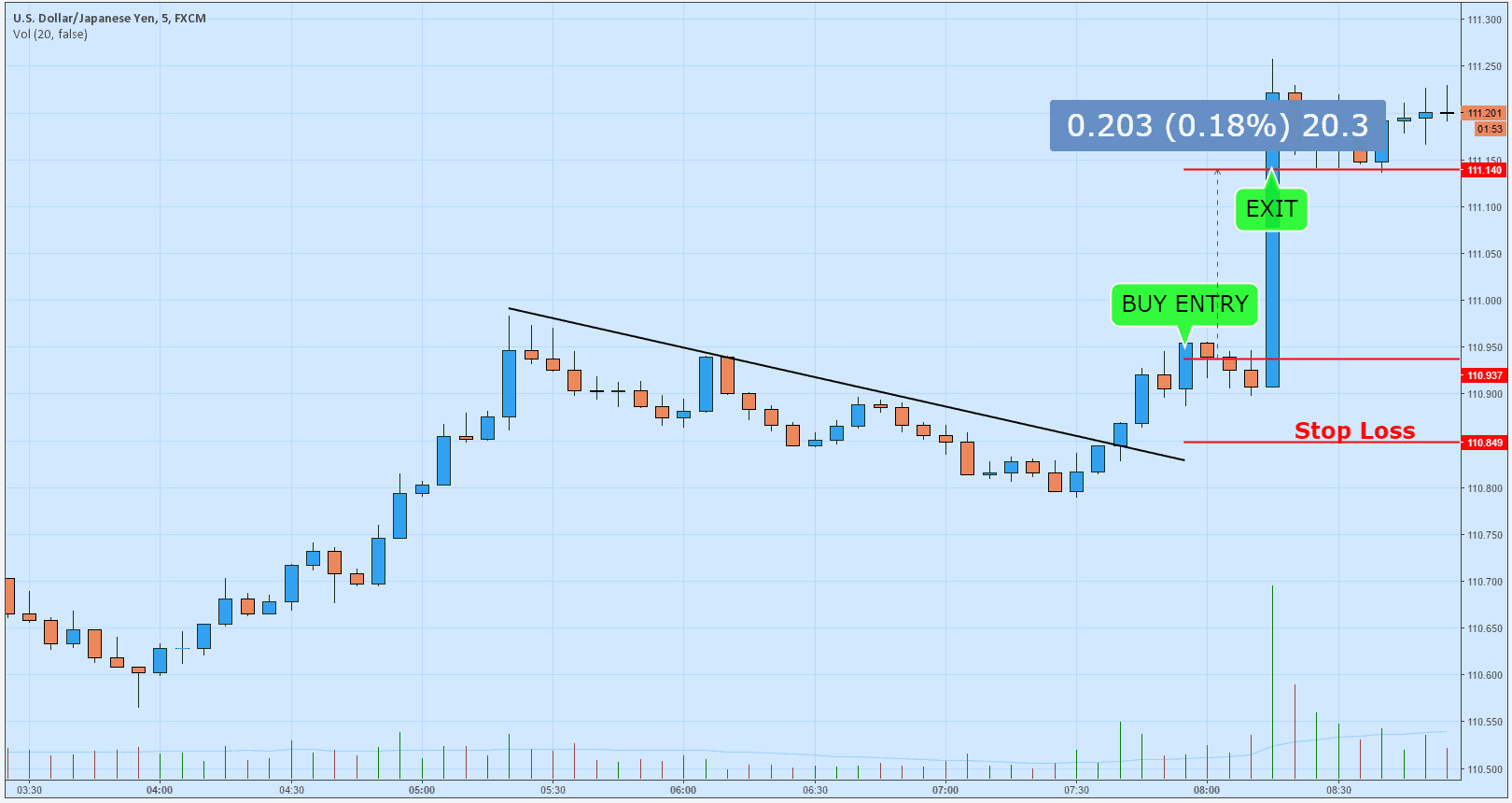

- 💲 Entry/Exit Points – Prices at which you “entered” or “exited” the market by finishing your buy or sell order

- 🎈 Float – This tells how many shares can be traded in total

- 🏁 IPO or Initial Public Offering – Amount of shares a company decides to sell upon becoming a public company

- ✖️ Leverage Rate – The rate at which your brokerage or agency can multiply your deposit

- 🍯 Pot – The money you have to spend in total for your day trade, or your total account balance

- 🛑 Stop-Loss – How much loss you tell your trading app to allow before the platform stops the trade

- 📊 RSI or Relative Strength Index – A series of signals that let you compare the gains and losses of a given stock

- 🤖 Trading Bots – These are automated programs that can open and close trades based on predetermined criteria or orders. Some brokerage apps use these more than others. Some trading bots are also called “roboadvisors” and can offer you trading advice based on algorithmic predictions

Final Thoughts

In the end, online trading is both complex and understandable by everyone with a little patience and some practice.

It’s a great idea to pick an excellent online trading app or platform to start your journey, and to read other trading guides before you make your first moves on the market. Remember to start slow and accept that you’ll have to stomach a few losses before your profits start coming in consistently.

But stick with it and you’ll eventually find the market to be profitable and a perfect tool for your investment goals.