Advertising disclosure

Hosting Canada is community-supported. We may earn a commission when you make a purchase through one of our links. Read Disclosure.

Questrade Review (CA 🇨🇦)

Deciding on an online brokerage that lets you take advantage of the stock market and begin investing for retirement is a big deal.

While there are plenty of online brokerages to choose from, only some are truly worthwhile.

Finding out whether a brokerage is a good option can take time and money, either of which you might be a little short on.

How does Questrade measure up? In this in-depth guide, we’ll break down this Canadian online brokerage and see how they operate, what they offer, and what they cost overall. Let’s get started in our Questrade review.

How Does Questrade Work for Traders?

Canadians can get in on trading and investing opportunities through Questrade, a discount brokerage that provides Canadian citizens with two trading platforms and zero annual account fees.

In case you don’t know what a trading brokerage is, here’s a summary: it’s a company that makes trades for you on the stock market across a variety of option or stock types.

Naturally, the quality of a trading brokerage like Questrade dictates whether it’s worth your time and money.

What Is Questrade?

Questrade began in 1999 and is currently headquartered in Toronto. At the moment, they’re one of the fastest-growing online brokerages between both Canada and the US.

This is largely because Questrade has made a name for themselves due to their low fees and their great choice between trading platforms.

Questrade is available to any resident in Canada and is a member of both CIPF (Canadian Investor Protector Fund) and IIROC (Investment Industry Regulatory Organization of Canada).

Both of these regulatory agencies ensure that trades going through Questrade are fair to both traders and brokers and provide smooth sailing for a wide variety of trading activities.

Canadian citizens can make all kinds of different trading accounts through Questrade, including retirement, margin, or managed accounts (accounts run by an experienced trader for a fee). Other Questrade Canada account types include:

- ☑️ tax-free savings accounts

- ☑️ registered education savings plans

- ☑️ locked-in retirement accounts

- ☑️ life income funds

- ☑️ much more

Where Does Questrade Operate?

Questrade is a Canadian company, but US residents are still able to open non-registered accounts with them. To this end, Questrade provides access to Canadian stock markets in addition to any US-based securities on the NYSE and NASDAQ, plus some other major exchanges.

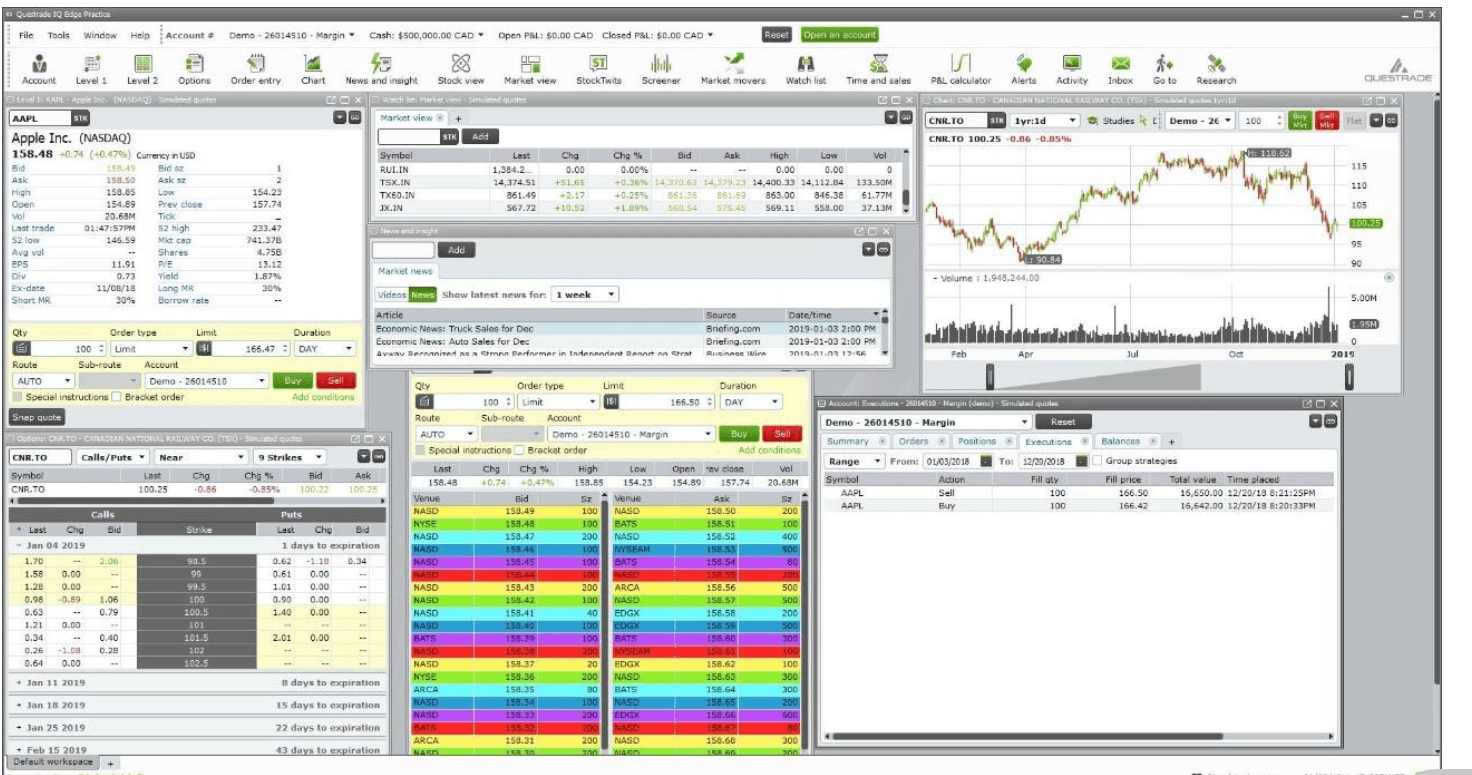

All traders who use Questrade will be able to choose between two quality trading platforms. These are the interfaces through which investors can look at the charts and other data resources provided by Questrade and then place orders with the brokerage.

The two platforms are IQ Web and IQ Edge, respectively. The first is browser-based while the other is desktop-based.

This means that they are both pretty similar in both overall layout and functionality, while still maintaining a few solid differences that give them advantages and disadvantages compared to one another.

For instance, IQ Web (the browser-based option) features an extremely clean interface and easy to use control scheme.

Most of the major buttons are well-organized on the left-hand side of the screen, and summaries of positions and balances can be found on the right, in addition to any stocks you want to watch or track.

Options chains, stock charts, and even streaming watch lists can be customized without too much trouble, and you can further customize the interface with eight additional widgets.

All in all, IQ Web gives both novice and experienced traders all that they need to manage their accounts and make big moves.

If you ever need help interpreting stock charts you can always count on our team’s guide on how to read stock charts.

IQ Web can run in virtually any browser, although Chrome is a particular favorite and works well with the widgets mentioned above.

IQ Edge, on the other hand, is a desktop platform exclusively and works with both Windows and Mac computers or operating systems.

Between the two, IQ Edge gives you significantly more trading tools and customization options, so it’ll be the favorite for active traders or investors with much more experience.

Once you open the screens, you’ll see that Edge’s charting options feature many more customization choices; for instance, you can add “quick trade” buttons for favored moves or even set alerts that are customizable for certain stocks or options.

You can also view both US and Canadian markets across twin windows for easy comparison.

Interestingly, day traders will benefit from the ability to skip an order confirmation window, allowing them to quickly secure trades without an additional step.

IQ Edge further comes with several themes ranging from black to blue to light, reducing the likelihood of you suffering from eyestrain. Everything runs pretty smoothly overall between both trading platforms.

But again, newer or more infrequent traders will probably prefer IQ Web versus IQ Edge, with the reverse being true for advanced or experienced traders.

What About Apps?

Questrade does provide access to a mobile app that is available for both Apple iOS and Android phones or tablets.

Questrade does provide access to a mobile app that is available for both Apple iOS and Android phones or tablets.

The Questrade app is pretty easy to manage and features a streamlined interface. Of course, it doesn’t have nearly as many tools as either the browser or desktop platforms.

However, you can still check your investments or make trades while on the move using the mobile app, which might be helpful for day traders or otherwise active investors.

If you are looking to start day trading, take a look at our detailed guide on how to make money day trading.

What Features Does Questrade Offer?

Like any online brokerage worth your time and money, Questrade does provide you with several research and analytical tools.

In fact, Questrade’s “Market Research” nexus is available front and center on the website whenever you log in. This hub provides you access to two main tools: Intraday Trader and Market Intelligence.

The latter of the two comes courtesy of Morningstar, a well-known stock market research provider. This gives you plenty of tools to analyze equities and ETFs that are traded in both the US and Canada, as well as individual securities reports.

A screener tool included in the Intelligence tool will help you figure out which ETFs or equities you should have your eye on.

Anyone looking into mutual funds research will want to check out the obviously-named Mutual Fund Centre, which also gets its data from Morningstar.

Anyone looking into mutual funds research will want to check out the obviously-named Mutual Fund Centre, which also gets its data from Morningstar.

This is great for Canadian traders, as it only focuses on Canadian funds instead of being cluttered with US stuff.

Intraday Trader is another great research tool you can use to come up with ideas for your next moves. In a nutshell, it runs off several automated algorithms that can present you with certain opportunities based on parameters you set beforehand.

It’s an excellent tool for beginners looking to learn the ropes of stock trading, but it’s also great for more experienced investors that want a little of the legwork lifted off their plates.

If the tool is not enough on its own you needn’t worry as we have prepared a beginner’s guide to online trading for you as well.

Furthermore, Questrade allows any account holder to purchase “market data packages”. These are basically collections of relevant data to certain markets, and there are four tiers:

The Basic market package is free with all accounts and provides you with real-time data of a security with a single click across several indexes and stock exchanges. This includes unlimited “snap quotes” for data points and prices

The Enhanced package is $19.95 per month, although the fee can be waived through a rebate. This provides even better live streaming data through a variety of American and Canadian exchanges

The Advanced US data package is $89.95 per month, and it’s only available to active trader accounts. This ties in to other benefits that active traders can benefit from.

This data package provides you with premium market data from liquid exchanges in the US, plus some additional Canadian streaming data

Finally, the Advanced Canadian data package is the exact same price but reverses the countries: you get liquid exchange data from Canada and select US streaming data

This all sounds a bit technical, but what it boils down to is better data so you can make better trading decisions.

It allows you to stay on top of world markets and certain market sectors, which could be advantageous if you are an active trader with volatile commodities or assets.

New traders probably won’t take advantage of these data packages very often (if at all), but there’s no denying their value for those who like to be very hands-on and micromanage their own accounts.

What is Opening an Account with Questrade Like?

Opening an account through Questrade is fairly simple. Signing up can be done online and in a single sitting. They require:

- ☑️ your full name and home address

- ☑️ your email address

- ☑️ a Questrade login and password

- ☑️ your social insurance number and employer information

- ☑️ your phone number

- ☑️ a photo of your government-issued ID

Filling out all this information takes just a few minutes, provided you get the material together beforehand. Then you only need to transfer some funds from your bank to Questrade.

This can be done by connecting your bank account directly to the brokerage. Be advised that this may take up to a few business days depending on your bank’s policies.

As with many online brokerages these days, you can open an account with no opening Questrade fees or costs. This being said, you do need a $1000 minimum account balance at all times.

It’s okay to dip below this from time to time if you’re making trades, but the above balance means you’ll need at least $1000 in your bank to open an account.

This may be a tall order for some folks, despite Questrade’s ostensible focus toward budget-friendliness.

Still, if you do have the cash, it’s easy to try out Questrade’s interface and even make a few trades because of this relatively low barrier to entry.

What Markets Are Open to Questrade?

Although Questrade presents itself as a budget online brokerage, they provide their investors with access to virtually any market you could want, with only a few exceptions.

Standard things like stocks, mutual funds, options, bonds, and ETFs are all available through Questrade’s interfaces. Even commodities like precious metals are available to every account.

However, Questrade also gives clients access to forex and CFDs, or contracts for difference.

Notably, clients are required to create a separate account if they want to trade in these markets – this is likely because of inherent or assumed risk compared to other market trades.

What Are Questrade’s Spreads and Fees?

Questrade provides its users with two pricing options if they want to trade options, stocks, or ETFs. The first of these is called “democratic” pricing.

Under this plan, normal stock trades cost $.01 per share and require a minimum charge of $4.95 and maximum charges of $9.95. Options traded under this plan cost $9.95 + $1 per contract. ETFs, on the other hand, are entirely commission-free.

The second pricing plan is called Questrade Advantage. It’s geared more toward active traders and requires that clients subscribe to one of Questrade’s Advanced market data plans, in addition to choosing between either a variable or fixed-rate pricing plan.

Under Questrade Advantage, costs run at $.10 a share with $.01 minimum and $6.95 maximum for the variable plan or, if the trader uses the fixed plan, $4.95 no matter what.

Options cost $6.95 and another $.75 for every contract for variable plan users or $4.95 and another $.75 per contract for the fixed plan. As with democratic pricing, ETF trades are totally commission-free.

Which will most people benefit from? The majority of investors using the Questrade brokerage will already be looking for something affordable and easy to understand, in addition to something that saves them money over the long-term.

The democratic pricing plan will, thus, the more popular for more people. It’s beneficial because pricing is capped if an investor wants to make a regular stock trade.

However, the Questrade Advantage plan does have its benefits. For instance, the Advantage pricing model provides some discounts when investors spend more with commissions (usually around $100 or more).

So if you’re making a lot of trades, the Advantage pricing model might be cheaper in the long run.

Either way, both pricing models provide one of the main attractive benefits of Questrade as a whole: there are no annual fees for any account with their service.

How Is Questrade’s Security?

![]() Being a Canada-based brokerage, Questrade’s security is taken pretty seriously.

Being a Canada-based brokerage, Questrade’s security is taken pretty seriously.

In our Questrade review, we discovered they’re registered investment dealers and members of both CIPF and IIROC.

Both organizations work together to oversee Questrade’s trades and other operations and make sure that there isn’t any illegal activity going on.

When it comes to your actual account, Questrade has no website vulnerabilities as it encrypts and securely stores all the information pertaining to your identity and account details.

There are additional security measures like touch-based or face ID scans you can implement with your mobile device or through your computer, plus simpler things like PIN numbers.

One added touch that we really like is the 100% promise Questrade makes to reimburse any unauthorized transactions that take place through your account if it results in direct losses.

Even better, every account is insured for up to $10 million if the brokerage itself becomes insolvent.

Note: Some users reported not being able to login to IQ Edge without using VPN protection.

Questrade Customer Service

Questrade does a pretty good job with customer service overall.

Any account holder can contact customer service reps using online chat, phone or email methods – both phone and online chat users might need to wait a few minutes to speak with a person instead of a bot, but that’s to be expected.

Email support, on the other hand, can take a few days until you get a reply.

In terms of in-depth knowledge, there are certainly brokerages that have customer service reps with better technical skill. However, Questrade does provide all of its account holders with access to a “How To” and Resources section of their website.

These pages can offer answers to questions for new investors, and there’s an additional YouTube page that you can browse for trading education or more in-depth technical discussions.

All in all, though, there are plenty of other online brokerages that provide better educational resources for their users.

Conclusion

Questrade is a pretty good choice for Canadians looking to either play the stock market conservatively and infrequently or become more active traders that want to try their chances of making a fortune playing with the charts.

They have a lot to like, including generally low fees, several cost rebates for active traders, free to buy ETFs, and low commissions compared to many other online brokerages.

They also have plenty of analytical tools and optional data packages to help you find success if you do want to take a more active role in your portfolio.

However, we’d still recommend it for any Canadian looking to give investment trading a try. We hope you enjoyed our Questrade review! It’s one of the best Canada-based online brokerages you can find. 🏆